Forex trading, also referred to as international trade trading or currency trading, could be the global marketplace for getting and selling currencies. It runs 24 hours each day, five times weekly, allowing traders to participate available in the market from everywhere in the world. The principal purpose of forex trading would be to benefit from changes in currency exchange costs by speculating on whether a currency set can increase or fall in value. Individuals in the forex market include banks, economic institutions, corporations, governments, and individual traders.

One of the crucial options that come with forex trading is their high liquidity, and therefore big amounts of currency can be purchased and offered without significantly affecting exchange rates. That liquidity ensures that traders can enter and quit jobs rapidly, allowing them to take advantage of even little value movements. Also, the forex market is extremely accessible, with minimal barriers to entry, enabling individuals to start trading with somewhat small levels of capital.

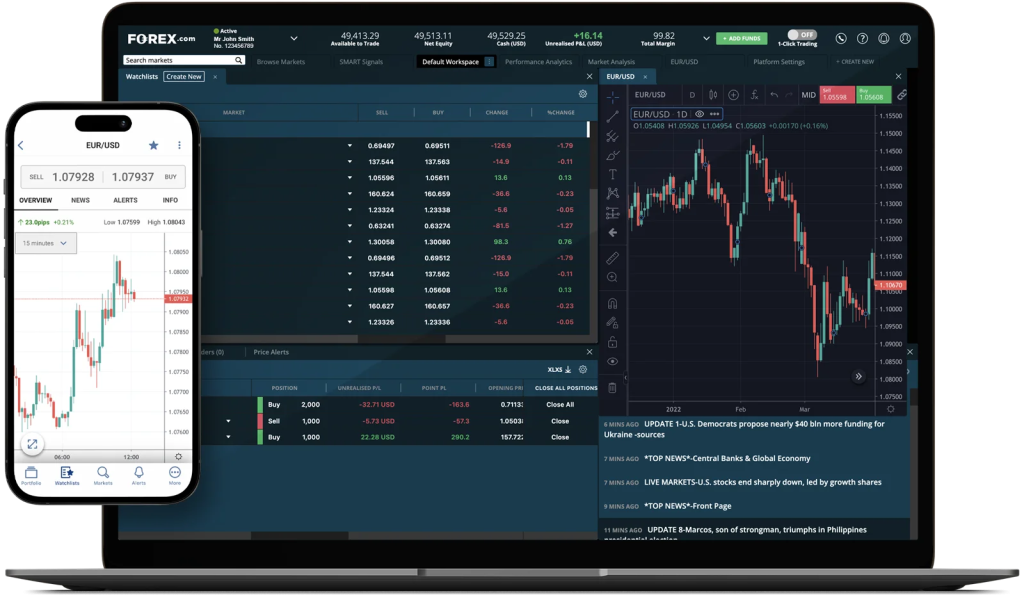

Forex trading supplies a wide variety of currency pairs to industry, including major sets such as EUR/USD, GBP/USD, and USD/JPY, in addition to modest and spectacular pairs. Each currency pair shows the exchange charge between two currencies, with the first currency in the couple being the base currency and the second currency being the estimate currency. Traders can make money from both climbing and falling areas by getting long (buy) or small (sell) positions on currency pairs.

Successful forex trading requires a solid knowledge of elementary and technical analysis. Fundamental analysis requires analyzing financial signs, such as fascination costs, inflation costs, and GDP development, to measure the underlying power of a country’s economy and its currency. Specialized examination, on one other give, involves considering cost maps and styles to identify tendencies and possible trading opportunities.

Chance management is also important in forex trading to protect against possible losses. Traders usually use stop-loss purchases to restrict their drawback chance and employ proper position dimension to ensure that no single business may significantly influence their overall trading capital. Furthermore, sustaining a disciplined trading strategy and managing thoughts such as greed and concern are important for long-term success in forex trading.

With the growth of technology, forex trading has be much more available than ever before. On line trading platforms and mobile programs give traders with real-time access to the forex market, permitting them to implement trades, analyze industry information, and control their portfolios from any device. More over, the availability of instructional forex robot assets, including courses, webinars, and test records, empowers traders to produce their abilities and improve their trading performance around time.

While forex trading presents significant income possible, in addition it holds natural dangers, like the prospect of significant losses. Therefore, it is needed for traders to perform thorough research, create a sound trading technique, and constantly monitor market conditions to make educated trading decisions. By staying with disciplined risk management practices and remaining informed about global financial developments, traders may improve their odds of success in the powerful and ever-evolving forex market.